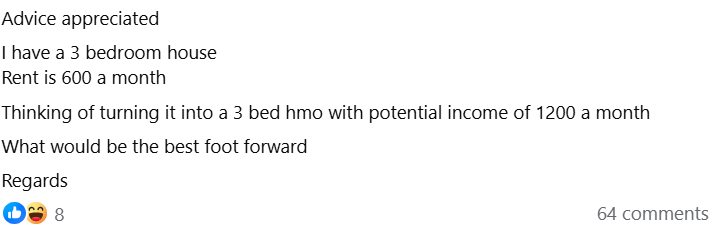

Hey fellow landlords! A practical question from the Landlord UK Facebook group is generating buzz: “I have a 3-bed house renting for £600 pcm. Thinking of turning it into a 3-bed HMO for £1,200 pcm. What’s the best foot forward?” If you’re a North East landlord in areas like Sunderland or Durham (where HMO yields average 12.5% per Excellion Capital 2025 research), this could boost your income significantly, but it requires careful planning to avoid pitfalls like licensing and costs. With the Renters’ Rights Bill 2025 mandating higher standards (EPC C by 2030, per GOV.UK), HMOs are a hot option for 10-15% yields, but for a 3-bed HMO (3 occupants), it’s simpler than larger ones. Let’s break this down engagingly, like a conversion blueprint, with verifiable steps, real-world scenarios, pros/cons, costs/yields, and North East tips to decide if £1,200 pcm is worth the effort.

The Issue Breakdown: HMO Conversion for a 3-Bed House A 3-bed HMO (3 unrelated tenants) doubles income (£600 to £1,200 pcm = 100% increase), with yields up to 12.5% in the North East (Excellion Capital 2025). No mandatory HMO license if under 5 occupants (Housing Act 2004, updated 2025), but check local additional licensing (e.g., Sunderland/Durham schemes for 3-4 occupants). Planning permission often not needed (permitted development for small HMOs, Planning Portal 2025), but building regs always apply for safety. Costs average £11,345 per bedroom (£34k for 3-bed, Excellion 2025), but North East is lower (£25k-£35k avg, Checkatrade 2025). Yields 12.5% in North East (Excellion 2025), up to 15.4% (Lendlord 2025). Best foot forward: Check local licensing, budget for costs, calculate ROI—worth it if yields exceed 10%.

Step-by-Step: Best Foot Forward for HMO Conversion

- Check Licensing Requirements (Week 1): No mandatory license for <5 occupants (Housing Act 2004, 2025), but additional licensing for 3-4 in areas like Sunderland/Durham (£500-£1,000 fee, 5 years, GOV.UK). Use GOV.UK checker (free). Scenario: A Sunderland landlord skipped additional license—fined £1k; got it for £600, re-let at £1,200.

- Planning Permission & Building Regs (Weeks 2-4): Permitted development for small HMOs (Planning Portal 2025), but building regs mandatory for safety (£500-£1,000 fee). Scenario: A Durham landlord added bedroom without regs—EPC failed, lost £1k rent; compliance added £15k value.

- Budget & ROI Calculation (Week 5): Costs £25k-£35k North East (Checkatrade 2025, £11,345/bedroom avg). ROI: £1,200 pcm (£14,400/year) vs. £600 (£7,200)—gross yield 32% vs. 16%, net 12-15% after costs (Excellion 2025). Scenario: A Sunderland landlord spent £30k on 3-bed HMO—yields hit 12.5%, profit doubled in 1 year.

- Execute Conversion (Months 2-4): Hire HMO specialist (£25k-£35k, 8-12 weeks). Ensure EPC C for Bill compliance (£500 upgrade if needed). Scenario: A Newcastle landlord converted for £28k—re-let at £1,200, ROI 15% in year 1.

- Re-Let & Monitor: Market as HMO (£1,200 pcm, 22 days void avg). Pro Tip: Use agent (£100-£150/month) for compliance.

Real-World Scenarios from Landlords

- Scenario 1: A Sunderland landlord converted a 3-bed house to HMO for £32k (full refurb)—licensed for £600, re-let at £1,200, net £8k/year vs. £4k BTL (12.5% yield).

- Scenario 2: A Durham landlord skipped additional licensing—fined £1,200, delayed re-let; got license, yields up 10%.

Best foot forward: Check licensing first, budget £25k-£35k, aim for 12.5% yield—worth it for doubled income.

Want exclusive hands-on landlord tips, fresh North East market insights, and high-yield investment opportunities delivered weekly? Join over 1,000 savvy investors in our free Property Sourcing Newsletter—no spam, just actionable value straight to your inbox. Sign up now and stay ahead in 2025!