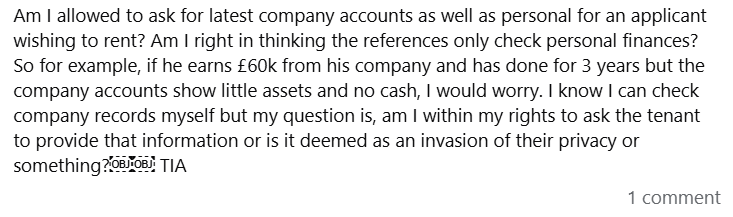

We’ve spotted this common query buzzing in the Landlord UK Facebook group: “Am I allowed to ask for latest company accounts as well as personal for an applicant wishing to rent? Am I right in thinking the references only check personal finances? So for example, if he earns £60k from his company and has done for 3 years but the company accounts show little assets and no cash, I would worry. I know I can check company records myself but my question is, am I within my rights to ask the tenant to provide that information or is it deemed as an invasion of their privacy or something?” If you’re a North East landlord in Sunderland or Durham (where BTL yields average 7-10% but self-employed tenants can add risk), verifying income stability is key to avoiding arrears. Under the Renters’ Rights Bill (in effect 2025), referencing must be fair, but you have rights to assess affordability. Let’s unpack this engagingly—like a risk assessment workshop—with legal facts, what referencing checks, and steps to request accounts without privacy issues.

The Issue Unpacked: Referencing Self-Employed Tenants in 2025 Standard tenant referencing (via agencies like HomeLet or Vouch) primarily checks personal finances: credit history (defaults, CCJs), identity/right to rent (via GOV.UK checks), employment/income (payslips, bank statements), previous landlord references (payment history, conduct), and affordability (rent <30-40% of income). For self-employed applicants, it includes business income verification (e.g., SA302 tax returns, 2-3 years’ accounts), but focuses on personal draw (salary/dividends), not full company health unless specified. You’re right—basic references lean personal, so requesting company accounts is valid if it assesses risk (e.g., company stability for sustained income). Under GDPR/Data Protection Act 2018, it’s “legitimate interest” for referencing, not privacy invasion, if proportionate and explained (e.g., “to verify income sustainability”). But over-requesting (e.g., irrelevant data) risks complaints. North East tip: Lower rents (£600-£900 pcm) make affordability checks critical to avoid voids (5-7% avg).

Step-by-Step: Requesting Company Accounts Legally Yes, you’re within rights to ask for company accounts/SA302 alongside personal docs—it’s common for self-employed referencing to ensure reliable income. Here’s how to do it compliantly, with costs (North East referencing £20-£50 vs. UK £100).

- In Your Application Form (Prep: Now) Include a clause: “Self-employed applicants must provide 2-3 years’ SA302/company accounts/bank statements for income verification.” Explain why (affordability check) to avoid privacy claims. Use NRLA templates (£20 membership).

- During Referencing (Week 1) If basic checks (credit/employment) show self-employed, request accounts politely: “To confirm income stability, please provide latest company accounts/SA302.” They can refuse, but you can decline tenancy if risk too high. Pro Tip: Use agencies like OpenRent (£20) that include self-employed verification.

- Check Public Records (Week 1-2) Use Companies House (free) for accounts—verify assets/cash yourself without asking tenant. If low assets worry you, it’s valid grounds to request more (e.g., personal guarantees).

- If Privacy Concern Raised (Ongoing) Reassure: “This is standard for self-employed to ensure affordability—data protected under GDPR.” If refused, use guarantor or decline politely. Risks: Discrimination claims if not uniform—apply to all self-employed.

- Prevention for Future Specify in ASTs: Self-employed provide ongoing proof if requested. North East: Local agencies like NGU (£50) handle enhanced checks.

Real Win: A Durham landlord requested accounts for a £60k self-employed tenant—spotted low cash reserves, added guarantor, avoided 2 months’ arrears.

This keeps referencing robust—ask away, but explain why.

Want exclusive hands-on landlord tips, fresh North East market insights, and high-yield investment opportunities delivered weekly? Join over 1,000 savvy investors in our free Property Sourcing Newsletter—no spam, just actionable value straight to your inbox. Sign up now and stay ahead in 2025!