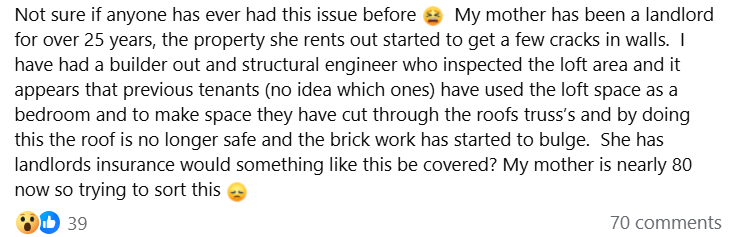

Popping up in the Landlord UK Facebook group is this tough spot: “My 80-year-old mum’s rental (let 25+ years) has cracks and bulging brickwork. Builder and engineer say previous tenants cut roof trusses to use the loft as a bedroom, making the roof unsafe. Does landlord insurance cover this?” If you’re a North East landlord in areas like Sunderland or Durham (where older properties often face similar mods, and yields average 7-10%), this is a nightmare—structural fixes can cost £5k-£20k. With the Renters’ Rights Bill (Royal Assent expected Sept/Oct 2025) emphasizing tenant protections, insurance claims are key. Let’s break it down engagingly, like a crisis workshop, with steps to check coverage, claim tips, and North East advice to protect your portfolio (and mum’s peace of mind).

The Issue Unpacked: Tenant Malicious Damage and Insurance Coverage Tenants altering structures (like cutting trusses for unauthorized use) is malicious damage if intentional—common in lofts turned bedrooms, causing subsidence/cracks. Standard landlord policies cover perils like fire/flood but often exclude tenant-caused damage unless you have “malicious damage by tenants” add-on (optional, extra premium). If covered, it includes structural repairs (e.g., roof reinforcement £10k-£15k North East avg per Checkatrade), but exclusions apply for wear/tear or if not reported promptly. For 2025, policies like Direct Line/Total Landlord offer this, but pitfalls include no add-on (claim denied) or lack of evidence (e.g., no police report). Pros: Claims average £2k-£5k for malicious damage. Cons: Excess £500+, and if tenants long-gone, proving malice is hard.

Step-by-Step Solutions: Checking Coverage and Claiming in 2025 Don’t assume—follow this plan to assess and act, with North East tips (e.g., lower engineer fees £300-£500 vs. UK £800).

- Review Your Policy Immediately (Prep: 1-2 Days) Dig out the policy document/schedule—look for “malicious damage by tenants/occupants” clause. Standard buildings cover (fire/flood/vandalism) might not include tenant acts; add-on does (e.g., Direct Line covers structural like ripped units or cannabis farms). Check exclusions: Accidental vs. malicious (cutting trusses likely malicious if intentional). North East: Providers like NRLA/AXA offer tailored add-ons—call helpline (free) or use apps like Policy Expert for quick scans.

- Gather Evidence for a Claim (Prep: 1 Week) If covered: Report to insurer ASAP (within 30 days typical). Submit: Engineer report (£300-£500 North East, e.g., via IES Ltd Sunderland), photos of damage/trusses, tenancy agreement (proving unauthorized alterations), police report if vandalism (call 101, free). Proof of tenant responsibility: Inventory/check-in report showing original state. Pitfall: No add-on? Claim denied—common top 5 issue. If not covered: Sue ex-tenants via small claims (£35-£115 fee) or deposit scheme (free TDS arbitration). Pro Tip: For 80-year-olds, use Power of Attorney (£150 setup) to handle.

- File the Claim and Mitigate (Week 2-4) Insurer assesses (surveyor visit, free). If approved, repairs covered up to buildings sum insured (avg £200k-£500k). Excess £250-£500. Loss of rent add-on (optional) covers voids during fixes (£1k/month typical). If denied: Appeal with more evidence or switch providers (e.g., Total Landlord for malicious add-on, £50-£100 extra premium). North East: Local builders like North East Roofers (£10k-£15k truss fix) offer insurance-friendly quotes. Grants (ECO4 £5k-£10k for energy upgrades during repairs) via Energy Saving Trust.

- Evict/Repair if Tenants Involved (Ongoing) If current tenants: Serve Section 8 notice (ground 12 for damage, 2 weeks). Past tenants: Trace via referencing agency (£20-£50). Safety first: If roof unsafe, emergency repairs (insurer may cover interim).

- Prevention for Future: Safeguard Your Portfolio Ban loft access in agreements; annual inspections (£50-£100). Add malicious damage cover (5-10% premium hike). Tenant refs/check-ins with photos. North East: NRLA local groups offer free templates; add-ons from AXA/Direct Line suit older properties.

Real Win: A Durham landlord claimed £12k for tenant-caused subsidence (similar truss issue)—add-on covered, via police report. Your mum can too—get pros involved for ease.

Want exclusive hands-on landlord tips, fresh North East market insights, and high-yield investment opportunities delivered weekly? Join over 1,000 savvy investors in our free Property Sourcing Newsletter—no spam, just actionable value straight to your inbox. Sign up now and stay ahead in 2025!