It’s understandably frustrating to deal with a tenant who has vacated without settling arrears or addressing property damages. Here’s a practical breakdown of your options:

1. Contacting the Guarantor

- Since the tenant’s mum is listed as a guarantor, she holds legal responsibility for any unpaid rent and damages, provided this was clearly stated in the guarantor agreement.

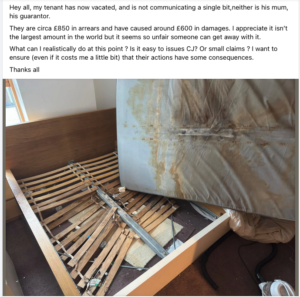

- Send a formal demand letter to the guarantor, outlining the total owed (£850 arrears + £600 damages = £1,450) and providing a clear deadline (e.g., 14 days) for payment. Include evidence of arrears and damages (e.g., tenancy agreement, rent statements, photos of damage).

2. Deducting from the Deposit

- If a deposit was held under a tenancy deposit protection scheme, you can make a claim for the arrears and damages through the scheme. Ensure you have documented proof of the damage and the costs involved (e.g., invoices for repairs).

3. Consider a Letter Before Action (LBA)

- If the guarantor or tenant does not respond, send a Letter Before Action (LBA). This is a formal warning that legal action (e.g., a County Court Judgment) will be pursued if payment isn’t made. Often, this prompts repayment to avoid legal proceedings.

4. Filing a Claim in Small Claims Court

- If no payment is received, you can file a claim through the Small Claims Court for the unpaid amount. This process is relatively straightforward:

- Claims under £10,000 are eligible for small claims.

- You can file online via the Government’s Money Claim service.

- There is a fee (e.g., ~£70 for your claim size), which can be added to the amount claimed.

- If the court rules in your favor, the tenant or guarantor will be legally required to pay. If they don’t, you can escalate enforcement (e.g., bailiffs).

5. Pros and Cons of a County Court Judgment (CCJ)

- A CCJ impacts the tenant or guarantor’s credit score, which can deter future financial irresponsibility.

- However, enforcing a CCJ requires additional steps if they still refuse to pay (e.g., employing bailiffs, attachment of earnings).

6. Practical Considerations

- Cost vs. Recovery: While the amount may feel small in legal terms, pursuing the claim could deter future bad behavior and serve as a warning.

- Communication Efforts: Continue attempts to contact the tenant or guarantor during this process. Sometimes, the threat of legal action is enough to resolve the matter without escalation.

- Emotional Toll: Small claims court is designed to be straightforward, but it may still require time and patience.

Final Thoughts

If you want to ensure there are consequences, issuing a small claims case or CCJ is a viable option, even if it costs a bit upfront. Start with a strong demand letter to the guarantor and prepare your evidence (tenancy agreement, payment records, damage photos, repair quotes). If they remain uncooperative, small claims is a logical next step.